Constitutional Money Class Resourse OSSBC

Old School Survival Bootcamp Class Resources and Outline

Constitutional Money Class Old School Survival Bootcamp

1. What is Constitutional Money?

If we understand, by currency, legal money of the country, and that which constitutes a lawful tender of debts, and is the statute measure of value, then undoubtedly nothing is included by gold and silver. Most unquestionably, there is no legal tender, and there can be no legal tender in this Country, under the authority of this government or any other but gold and silver, either the coinage of our mints or foreign coins regulated by Congress. This is a constitutional principle perfectly plain and of the very highest of importance. The states are expressly prohibited from making anything but gold and silver as payment of debts and although no expressed prohibition is applied to Congress yet as Congress has no power granted to it in this respect but to coin money and to regulate the value of foreign coins. It clearly has no authority to substitute paper or anything other than gold and silver as a tender in payments in a discharge of contracts…the legal tender therefore, the Constitutional standard of value is established and cannot be overthrown. To overthrow it would shake the whole system. Daniel Webster 1832

Coining Money Is Not Printing Paper Because There Is NO Fixed Standard of Value

The framers of the Constitution made their intention clear by the use of the word “coin,” rather than the word “print,” or the phrase “emit bills of credit.” Thomas Coley says “to coin money is to stamp pieces of metal for the use as a medium of exchange in commerce according to fixed standards of value.”

2. Why hold a Constitutional Money Class at a Survivalist/Homesteading Conference?

Most of us are prepping because we feel an overwhelming need to get back to the land and the old ways. We are here not just because we enjoy the lifestyle of slower-paced traditional methods but we feel deep down it’s the right then to do because we have become dependent upon a system that is too complex. Take one cog out of the wheel and you might wreck your bike as we have seen with covid.

Supply chains are very fragile. We want to remove ourselves from the fragility of those market turns and corporate decisions. In 1929 when the stock market collapsed 35% of Americans were out of work. Banks closed. Insurance companies failed. Businesses locked their doors but people with a little land were able to grow food and livestock and often shared it with others- See We Had Everything But Money

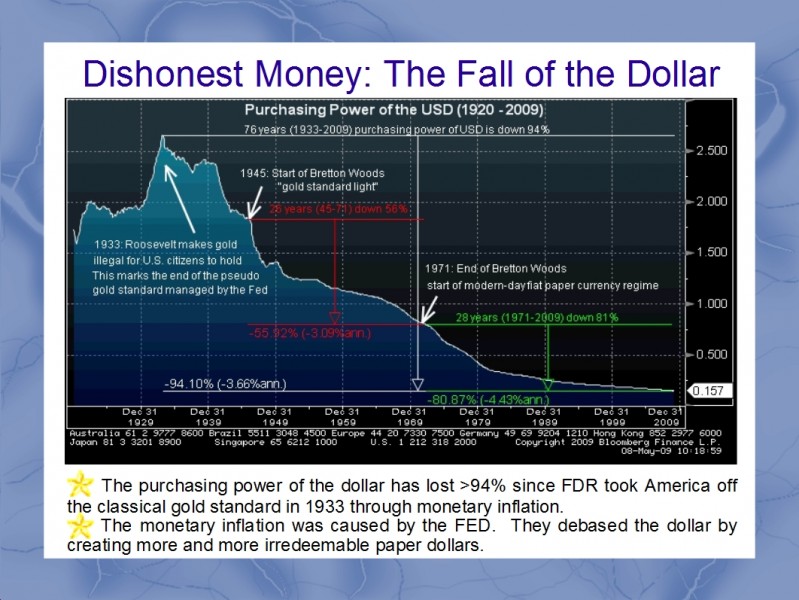

We are headed for a financial collapse. It’s not a matter of If but when. The collapse of 2008 wasn’t solved it kicked the can down the road and made it worse. We are 30 Trillion in debt with no plan to pay that back. You are here at a survival conference but we don’t want you just to survive. We want you to thrive. When you understand the necessity of Constitutional Money, aka sound money, you can position yourself to be the lender and not the borrower. Deuteronomy 15:6 You shall lend to many nations and borrow from none

Under the Constitution, Congress has the power to coin money, not print coin substitutes.

Roger Sherman- delegate to the Constitutional Convention

If what is used as a medium of exchange is fluctuating in its value, it is no better than unjust weights and measures, which are condemned by the laws of God and man

3. History of Money

Society Without Money

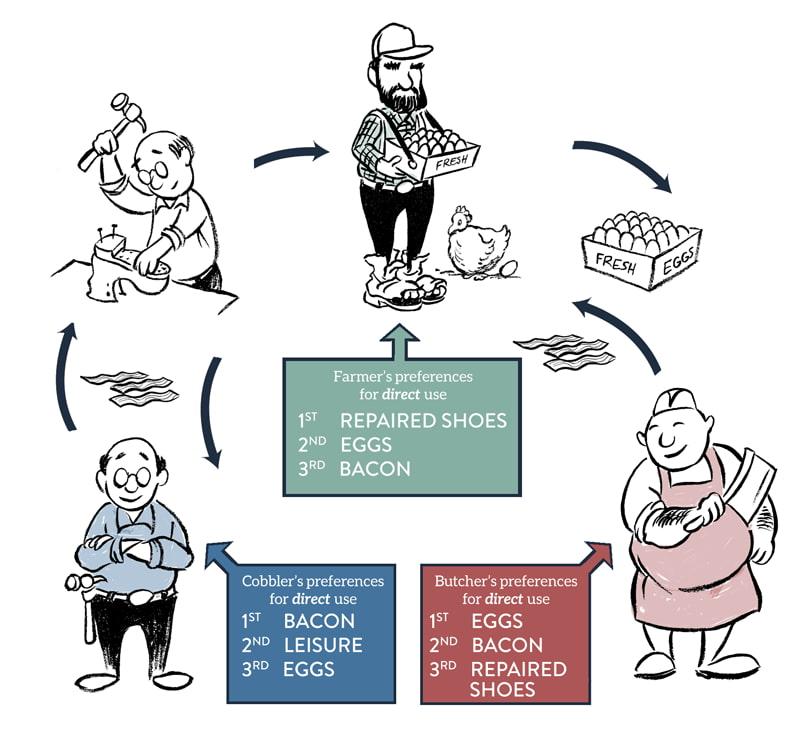

Direct Exchange- Barter

Indirect Exchange- Example Farmer with Eggs, shoemaker, hog farmer

Medium of Exchange- aka livestock, shells, tobacco, gold and silver

A) ease of transport

B) durability

C) convient size & weight

D) homogenous – example diamonds are NOT- 1 large diamond is worth more than 5 small ones in weight

E) Recognizable

Gold and silver fit all of these, you can get gold coins in a uniform size and purity

4. History of The first known use of coined metal for money

King of Babylon, Code of Hammurabi mentions silver in 1870 BC

4th Century BC – debasement when Dionysius, Tyrant of Syracuse owed too much money and demeaned everyone turn in their drachmas to be melted down and given a value of two.

nuggets of gold, copper, and silver were exchanged by weighing them

Paper money

Given that paper is widely believed to have originated in China, it is fitting that that country introduced paper currency. This innovation is widely thought to have occurred during the reign (997–1022 CE) of Emperor Zhenzong. It was made from the bark of mulberry trees (so, in a sense, money really did grow on trees). By the late 18th and early 19th centuries, paper money had spread to other parts of the world. The bulk of this currency, however, was not money in the traditional sense. Instead, it served as promissory notes—promises to pay specified amounts of gold or silver—which were key in the development of banks.

Rome didn’t actually mint gold coins with a value on them until about 200 BC but it was shortlived

About 150 yrs later, Rome authorized ordinary monetizers to coin money but soon people were shaving them and lighter coins were used in trading

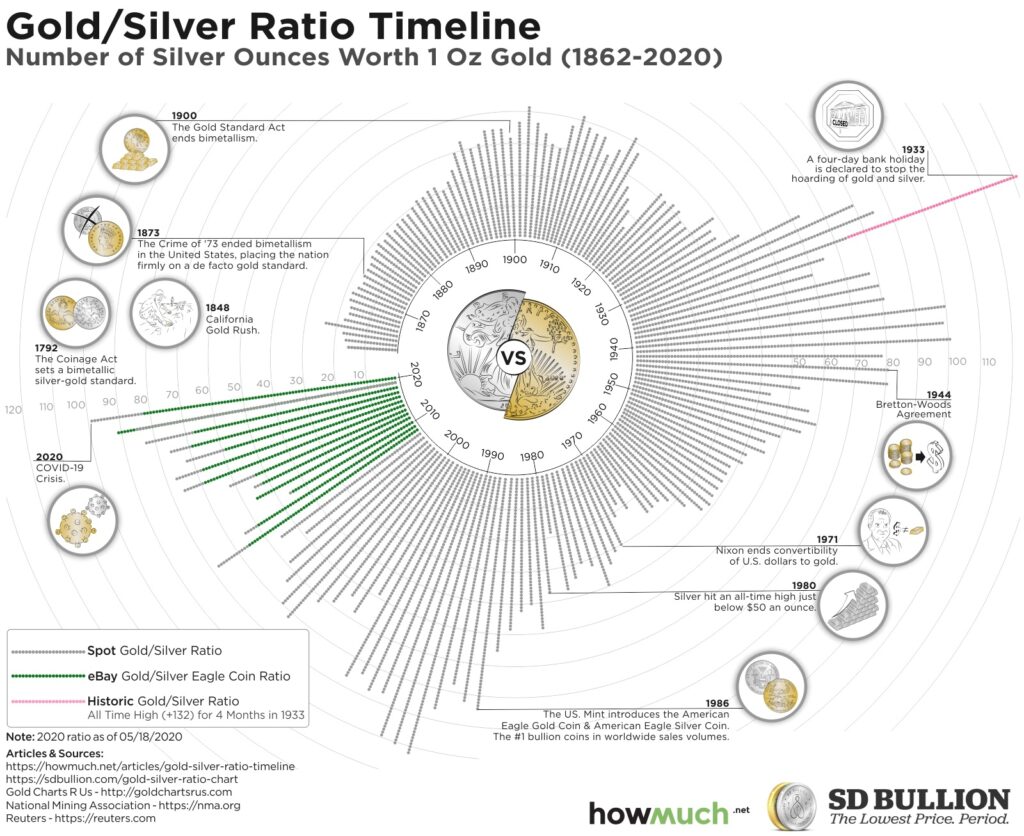

Augustus gave gold a place above silver at a rate of about 12 1/2 to 1

Middle Ages much trade was done by barter

Of the coins in circulation, most were copper and silver with occasional gold mintings

The Brits are the gold standard of the gold standard- printing gold coins for

5. Gold and Silver In the Bible- God’s Money

Ancient Israelites used gold, silver, and barley.

Gold in Eden And a river went out of Eden to water the garden; and from thence it was parted, and became into four heads. The name of the first is Pishon: that is it which compasseth the whole land of Havilah, where there is gold; And the gold of that land is good.”

Genesis 2:10-12a

The Bible says God created the world and the elements within it. Gold is depicted as an asset of value.

“The silver is mine, and the gold is mine, saith the Lord of hosts.”

Haggai 2:8

Gold and silver are products of God – they are not a creation of man

The gold standard and the silver standard are terms used throughout the history of currency. The ‘silver standard’ linked the Price of silver and barley (Leviticus 27:16).

In early biblical times, ‘money’ just meant pieces of silver that were checked for purity with a touchstone and weighed out when a transaction was made (Jeremiah 32). Money belonged to the people. Silver was used for trade and transactions while gold became a way to hold and preserve wealth

These unique properties of gold and silver have served as benchmarks of value throughout scripture. One notable reference is a metaphor used by the Apostle Paul.

“Now if any man build upon this foundation gold, silver, precious stones, wood, hay, stubble; Every man’s work shall be made manifest: for the day shall declare it, because it shall be revealed by fire; and the fire shall try every man’s work of what sort it is.”

1 Corinthians 3:12-13

God HATES Counterfeit Money

A false balance is abomination to the Lord: but a just weight is his delight.”

Proverbs 11:1

“A just weight and balance are the Lord’s: all the weights of the bag are his work.”

Proverbs 16:11

God created gold and silver as the backbone of economic growth. Precious metals act as a balance and a perfect unit of measure.

In the Bible, gold and silver are synonymous with money. In Hebrew, there was no word for money. Every Biblical passage that refers to “money” is a unit of weight in gold, silver, or another metal. Silver was used for day-to-day purchases, and gold was viewed as approximately twenty-fold the value of silver. It is worth noting when the United States operated on the Gold Standard, an ounce of silver was worth about $1 and an ounce of gold was worth approximately $20.

The denarius that Jesus held in Matthew 22:19 was a perfect example of the dangers of this. When it was first minted around 211 BC it was made from almost pure silver and weighed around 4.5 grams, but over the years both its size and purity were reduced. In Jesus’ time it contained around 3.9 grams of silver, and later in the 30s AD the emperor Nero further reduced the silver content. By the middle of the third century AD it was a copper coin with no more than a thin plating of silver.

One silver denarius was the standard rate of pay for a day’s labor (Matthew 20:2).

Silver was resistant to inflation. Jeremiah paid 17 shekels for a field (Jeremiah 32:9), and Zechariah 11 records the prophet throwing 30 silver pieces to the Potter in the Temple; nearly six hundred years later, Judas’s 30 silver pieces bought the Potter’s field (Matthew 27:9-10). At a rate of 2% inflation, the target rate for many governments today, the field Jeremiah purchased for 17 shekels would have cost around 2.5 million shekels by the time of the crucifixion.

After stealing from Jesus for over three years, Judas betrayed him to the Romans for thirty pieces of silver. This moment had been prophesied in Zechariah (Zechariah 11:12-13)

6. History of Money in America

In 1788, Thomas Jefferson wrote: “Paper is poverty. It is only the ghost of money, and not money itself.”

Foreign Coins- Before gold and silver were discovered in the West in the mid-1800s, the United States lacked a sufficient quantity of precious metals for minting coins. Thus, a 1793 law permitted Spanish dollars and other foreign coins to be part of the American monetary system. Foreign coins were not banned as legal tender until 1857

A. Early Colonial America

So the Colonists fashioned their own. They used tobacco, rice or Native American wampum—lavish belts of beaded shells—as a temporary currency. They also used the Spanish dollar, a silver coin that was, at the time, the most widely used currency worldwide. (The terminology stuck: This is why the government later decided to call its currency the “dollar” rather than the “pound.”)

A young Ben Franklin decided that the United States needed more. He’d noticed that whenever a town got an infusion of foreign currency, business activity suddenly boomed—because merchants had a trustworthy, liquid way to do business. Money had a magical quality: “It is Cloth to him that wants Cloth, and Corn to those that want Corn,” he wrote, in a pamphlet urging the Colonies to print their own paper money

B. Not Worth a Continental

Massachusetts sold notes to the public to fund its battles in Canada in 1690, promising that citizens could later use that money to pay their taxes. Congress followed suit by printing fully $200 million in “Continental” dollars to fund its expensive revolution against Britain. Soon, though, disaster loomed: As Congress printed more and more bills, it triggered catastrophic inflation. By the end of the war, the market drove the value of a single Continental to less than a penny. All those citizens who’d traded their goods for dollars had, in effect, just transferred that wealth to the government—which had spent it on a war.

Peletiah Webster, a discerning contemporary of the Revolution, summed up the effects of the American experiment with the continental. “Paper money,” said Webster, “polluted the equity of our laws, turned them into engines of oppression, corrupted the justice of our public administration, destroyed the fortunes of thousands who had confidence in it, enervated the trade, husbandry, and manufactures of our country, and went far to destroy the morality of our people.”

In 1780, Congress repudiated its solemn dollar-for-dollar promises and announced specie redemption at a rate of one specie dollar for forty dollars of continentals. The result of this ignominious end of the continental was a surprisingly quick return to a specie circulation, and a rapid fall of prices to a stable level.

Here Lies

A courageous American contemporary wrote a fitting epitaph to the continentals:

It becomes rulers to learn from the catastrophe of our Continental Currency, that money is upon a footing with commerce or religion. They all refuse to be the subject of law. It becomes the rulers of free men to learn further that money is property, and that the least attempt to lessen its value in our pockets and chests is taxing us without our consent. It is the highest act of tyranny. We have tried every art and device to keep up the credit of paper money except one — we have never yet tried the effects of being honest.

C) Constitutional Money

With the ratification of the U.S. Constitution in 1788, Congress gained the authority to develop a national currency. The Coinage Act of 1792 not only established the U.S. Mint but also fixed the dollar to 24.75 grains of fine Gold and 371.25 grains of fine Silver. Congress instructed that the very first coins must include representations of both liberty and an eagle. Thus, the first Gold coins were minted in denominations of $10 Eagles, $5 Half Eagles and $2.50 Quarter Eagles. Silver coins followed in denominations of Silver dollars, half dollars, and quarter dollars. Each coin contained its actual designated weight and value in Gold and Silver

With the adoption of the Constitution, Jefferson hoped the nation would go back to pre-revolution days with government issuing its money based on a precious metal standard. The treasury could then set up branches for loaning money and all payments of interest would go to the general funds of the nation, thereby greatly reducing the required taxes.

The first of Jefferson’s hopes was realized when the gold and silver standard was explicitly written into the Constitution. However, his second hope was shattered when Alexander Hamilton was appointed Secretary of the Treasury and came up with a plan to monetize the nation’s mammoth war debt by issuing bonds and selling them to private banks. He also urged the President and Congress to allow these bankers to temporarily (for twenty years) establish a private bank in the name of the United States and be responsible for issuing money , controlling the amount, fixing its value, and financing the United States government. It was this last factor which appealed to President Washington.

There was, of course, no Constitutional authority to have the federal government set up such a bank, but Hamilton persuasively argued a theory of “implied powers” which has seriously damaged the whole concept of ‘limited government’ ever since. Although the argument was sufficiently strong to impress Congress, Washington was uncomfortable with it. In fact, he was actually contemplating a veto of the banking act when Hamilton drew him aside and filled his mind with such glowing promises of stability and prosperity under this “temporary” expediency, that Washington finally overrode his professional instinct as one of America’s most successful farmers and signed the bill. Jefferson later accused Hamilton of complicating the whole scheme with such elaborate trappings that it had confused the President. It turned out that Washington’s original instinctive anxieties concerning the dangers of the bill were fully justified.

Over the decades since then and through a series of man-made boom and bust cycles, the powerful banking lobby, with the behind-the-scenes pressure from Wall Street, has persuaded Congress to give them permanent authority over our money and credit in violation of the Constitution and the express will of the people. This power was permanently consolidated in 1913 into the misnamed Federal Reserve System, which is neither “federal” nor “reserve.” Time and time again the big bankers who privately control the Federal Reserve have shown elected officials in Washington that indeed they are the ones that have the real power in our land.

This tension went all the way to the drafting of the Constitution. James Madison argued “nothing but evil” could come from “imaginary money.” If they were going to have currency, it should only be silver and gold coins—things that had real, inherent value. John Adams hotly declared that every dollar of printed, fiat money was “a cheat upon somebody.” As a result, the Constitution struck a compromise: Officially, it let the federal government mint only coins, forcing it to tether its currency to real-world value. As for the states? Well, it was OK for financial institutions in the states to issue “bank notes.” Those were essentially IOU’s: a bill that you could later redeem for real money.

The Coinage Act of 1792 then set specific ratios for gold and silver coinage, placing gold and silver in control rather than a central bank. This lasted until the passage of the Federal Reserve Act of 1913,

Section 19 of coinage act of 1792: death penalty for debasing currency

And be it further enacted, That if any of the gold or silver coins which shall be struck or coined at the said mint shall be debased or made worse as to the proportion of the fine gold or fine silver therein contained, or shall be of less weight or value than the same out to be pursuant to the directions of this act, through the default or with the connivance of any of the officers or persons who shall be employed at the said mint, for the purpose of profit or gain, or otherwise with a fraudulent intent, and if any of the said officers or persons shall embezzle any of the metals which shall at any time be committed to their charge for the purpose of being coined, or any of the coins which shall be struck or coined at the said mint, every such officer or person who shall commit any or either of the said offenses, shall be deemed guilty of felony, and shall suffer death. section 19 of coinage act of 1792

In a letter to John Epps written in 1813, Thomas Jefferson declared gold and silver the best form of money.

Specie is the most perfect medium, because it will preserve its own level; because having intrinsic and universal value, it can never die in our hands.”

He went on to write:

The trifling economy of paper, as a cheaper medium, or its convenience for transmission, weighs nothing in opposition to the advantages of the precious metals… it is liable to be abused, has been, is, and forever will be abused, in every country in which it is permitted.”

Among James Madison’s papers were notes for a 1786 speech opposing paper money. He wrote, “Right of regulating coin given to Congs. for two reasons. 1. for sake of uniformity. 2. to prevent fraud in States towards each other or foreigners. Both these reasons hold equally as to paper money.”

Alexander Hamilton also warned us about unbacked paper money.

To emit an unfunded paper as the sign of value ought not to continue a formal part of the Constitution, nor ever hereafter to be employed; being, in its nature, pregnant with abuses, and liable to be made the engine of imposition and fraud; holding out temptations equally pernicious to the integrity of government and to the morals of the people.”

• George Washington wrote to Thomas Jefferson on Aug. 1, 1786, “Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.”

• Alexander Hamilton, America’s first Treasury secretary, warned: “To emit an unfunded paper as the sign of value ought not to continue a formal part of the Constitution, nor ever hereafter to be employed; being, in its nature, pregnant with abuses, and liable to be made the engine of imposition and fraud; holding out temptations equally pernicious to the integrity of government and to the morals of the people.”

Jefferson’s experience with fiat currency surely influenced his views. “If we determine that a Dollar shall be our Unit,” he wrote in 1784, “we must then say with precision what a Dollar is.” Indeed, the Coinage Act of 1792 declared each dollar worth 371.25 grains of pure silver or 24.75 grains of pure gold.

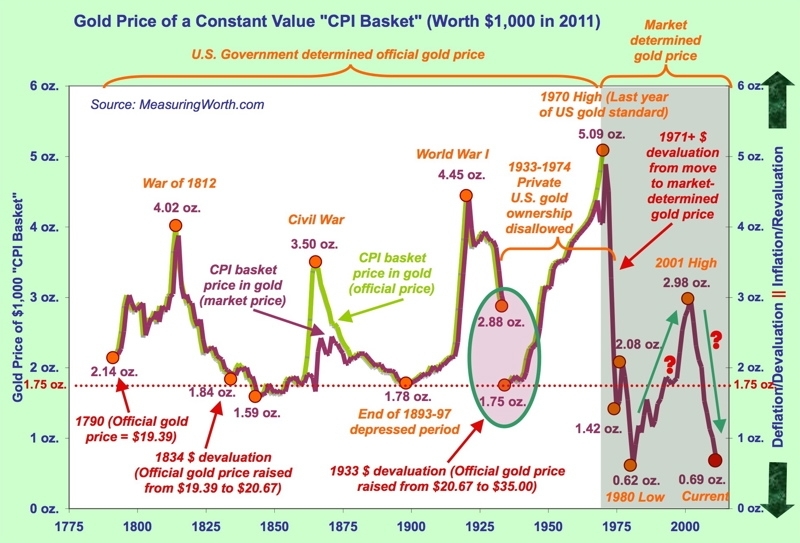

For 179 years, the dollar and gold remained linked.

D) The Civil War

ABANDONING THE GOLD STANDARD TO FINANCE THE CIVIL WAR (1862-1879)

In desperate need of funding for the Civil War, Congress passed the Legal Tender Act in 1862. Paper currency was guaranteed only by the full faith and credit of the United States and could not be redeemed for Gold. During this time, the Union printed $450 million in paper currency and inflation rose by 80 percent. By the end of the Civil War, the national debt had reached $2.7 billion.

Timberlake, Professor Richard Timberlake in his magisterial 2013 book Constitutional Money, devotes the bulk of the book to discussion and analysis of the Supreme Court’s decisions in cases involving money. Of those, the most crucial were the post-Civil War Legal Tender Cases, a series of disputes arising out of the federal government’s resorting to the printing of paper money, declared to be legal tender, to help pay for the enormous costs of the war.

The second of those cases, Knox v. Lee, (1871) was a disastrous break with the language and intent of the Constitution. A Republican-dominated Court (in those days, the Democrats were the “hard money” party) held that there was nothing unconstitutional about the “greenbacks” and making them legal tender. Worse still, the majority opinion went further, holding that the government has “general power over the currency, which has always been an acknowledged attribute of sovereignty.”

That idea, Timberlake argues, is entirely at odds with the meaning of the Constitution, which clearly did not give the government any such authority. The majority, he writes, “offered a nationalistic apologia” for unrestrained federal control over money. Thus, Knox v. Lee undermined the monetary constitution and opened the door to any and all government monetary schemes under the unconstitutional rubric of “sovereignty.”

Timberlake’s chapters on the history of the Fed are extremely illuminating. The Fed, he notes, was not initially created to be a central bank. Central banks can create money and the Fed was not supposed to do that under our constitutional gold standard. Timberlake explains, “It was to be a Gold Standard Central Bank, and to do occasionally what the gold standard did constantly – provide seasonal money as needed, commensurate with seasonal spikes in productions of commodities….It was not created as a centralized manager of the monetary system with unlimited powers, as the legal tender cases had implied, but as a technical device to reduce occasional instabilities appearing in the commercial banking system.”

Some politicians saw the dangers and warned that the Fed would burst its apparent bonds and soon become a money-creating engine. For example, Senator Frank Mondell of Wyoming presciently observed, “The Federal Reserve Board under this bill is an organization of vastly wider power, authority, and control over currency than the reserve associations contemplated by the National Monetary Commission….It is of a character which in practical operation would tend to increase and centralize [power.]”

In response to hyperinflation, Congress moved to decrease the money supply by discontinuing the production of Silver dollars. Bank defaults and an economic depression ensued but the move successfully reined in inflation. With the hope of bringing renewed economic prosperity, public opinion swayed toward a return to the Gold standard. In 1875, Congress passed the Specie Payment Resumption Act, which ensured that by 1879, all paper currency could be redeemed for Gold.

E. Fight Between Gold and Silver

Those struggling under deflation and members of the Democratic Party grew in political power and called for an expansion of the Silver currency, which would have increased inflation and provided immediate financial relief to many lower-income Americans. Meanwhile, Republicans promised strict adherence to a Gold standard as a mode of ensuring long-term economic growth and stability. Republican President William McKinley prevailed and further cemented the Gold standard by completely discontinuing the use of Silver as part of the dollar’s valuation

7. 1913- 2023… Fiat Fraud

A. The Federal Reserve

The Gold standard further evolved with the creation of the Federal Reserve System in 1913. This allowed the Federal Reserve to print paper currency while maintaining that 40% of the currency’s value be reserved in Gold.

Congress created the Federal Reserve, yet it had no constitutional authority to do so. We forget that those powers not explicitly granted to Congress by the Constitution are inherently denied to Congress – and thus the authority to establish a central bank never was given.

World War 1 Only possible with fiat dollars as country after country left sound money – Page 37

B. FDR’S MOVE AWAY FROM THE GOLD STANDARD AND THE BRETTON WOODS SYSTEM (1933-1971)

FDR’s ” Bank Holiday” March 6 1933 – Ordered banks to exchange their gold holdings for fiat paper.

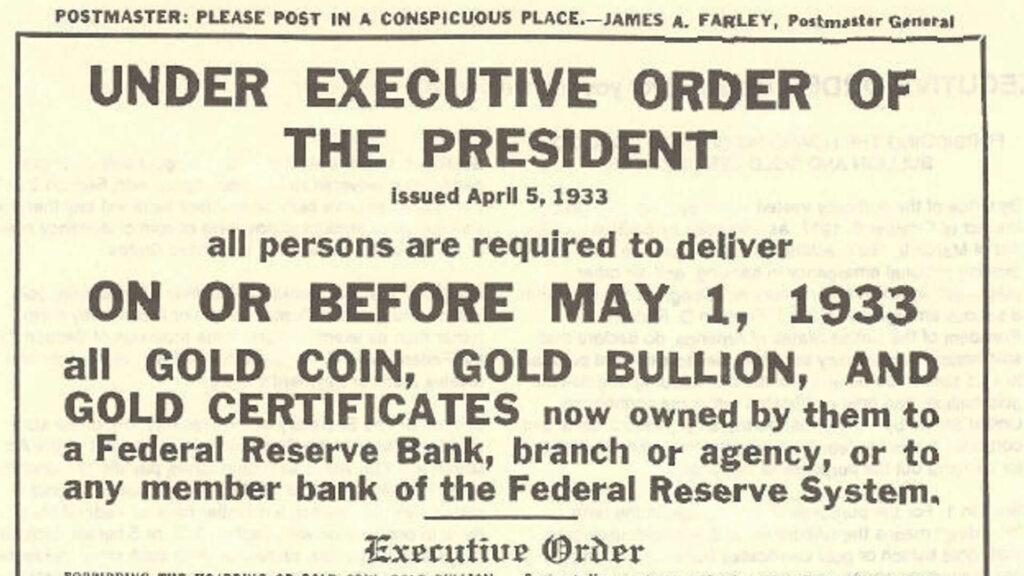

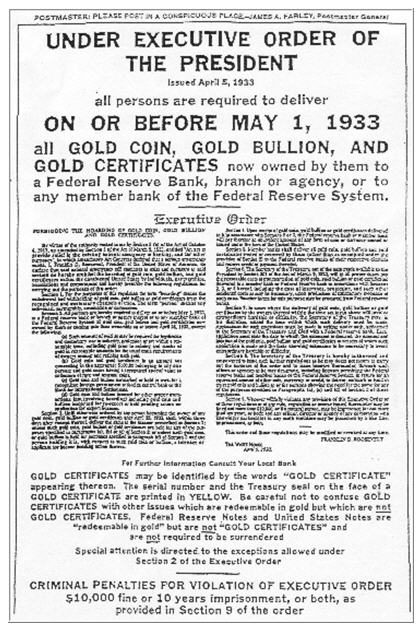

Prison time if you Didn’t Turn in Your Gold!

$10,000 Fine or 10 yrs in prison

In 1933, President Franklin D. Roosevelt used executive authority to make it illegal for citizens to privately hold Gold outside of jewelry. All Gold coins and bullion were ordered to be turned into the government for compensation at $20.67 per ounce. By 1934, a new Gold price of $35 per ounce was set and guaranteed indefinitely. Private citizens could no longer redeem paper currency for Gold. Buying Gold for investment purposes was forbidden. It could only be used in transactions with foreign governments. Forgeiners could still obtain US Gold while US citizens could not. Dollar was devalued by 41%

New $35 an ounce

The Federal Reserve was mandated to maintain stability according to the set Gold price. During this time, American paper currency provided a reliable standard for international trade and investment. In 1944, President Roosevelt worked with leaders across the globe to create the Bretton Woods system in which nations agreed to restrict inflation to no more than 1%. The Gold price remained set at $35 per ounce in the United States until 1971.

C. ADOPTION OF A FIAT MONETARY SYSTEM (1971-PRESENT DAY)

In 1971, as the Gold stockpile at Fort Knox dwindled due to international transactions, President Richard Nixon announced that foreign countries could no longer redeem dollars for Gold. Moving forward, paper currency was ensured only by the full faith and credit of the United States and a fully fiat monetary system was adopted.

Demand for federal funds led to double-digit inflation into the 1980s. Some recommended a return to the Gold standard to rein in inflation. The Federal Reserve, however, gained support from President Ronald Reagan in its efforts to reduce the money supply and thereby reduce inflation without being restrained by the Gold price. In 1985, the U.S. Treasury began selling Gold coins to the public for the first time in more than 50 years.

U.S. military predominance…No other government has ever had anything remotely like this sort of capability. In fact, a case could well be made that it is this very power that holds the entire world monetary system, organized around the dollar, together.

8. Reverse the Curse By Using Gold and Silver

cm-resources

23 US states move to reclaim gold and silver as legal tender

Sen. William Eigel (R) filed SB100 last month. The legislation would take several steps to encourage the use of gold and silver as money in Missouri, including making it legal tender, eliminating the state capital gains tax on gold and silver, and establishing a state bullion depository.

Legal Tender and Tax Reforms

Under the proposed law, gold and silver would be accepted as legal tender and would be receivable in payment of all public and private debts contracted for in the state of Missouri. Practically speaking, this would allow Missourians to use gold or silver coins as money rather than just as mere investment vehicles. In effect, it would put gold and silver on the same footing as Federal Reserve notes.

Missouri could become the fourth state to recognize gold and silver as legal tender. Utah led the way, reestablishing constitutional money in 2011. Wyoming and Oklahoma have since joined.

The effect has been most dramatic in Utah where United Precious Metals Association (UMPA) was established after the passage of the Utah Specie Legal Tender Act and the elimination of all taxes on gold and silver. UPMA offers accounts denominated in US-minted gold and silver dollars. The company was also instrumental in the development of the “Utah Goldback,” described as “the first local, voluntary currency to be made of a spendable, beautiful, physical gold.”

SB100 would also exempt the sale of gold and silver bullion from the state’s capital gains tax. Missouri is already one of 41 states that do not levy sales tax on gold and silver bullion. Exempting the sale of bullion from capital gains taxes takes another step toward treating gold and silver as money instead of commodities. Taxes on precious in metal bullion disincentivize investment and erect barriers to using gold and silver as money by raising transaction costs.

Imagine if you asked a grocery clerk to break a $5 bill and he charged you a 35-cent tax. Silly, right? After all, you were only exchanging one form of money for another. But that’s essentially what a sales tax on gold and silver bullion does. By eliminating this tax on the exchange of gold and silver, Virginia would treat specie as money instead of a commodity. This represents a small step toward reestablishing gold and silver as legal tender and breaking down the Fed’s monopoly on money.

“We ought not to tax money – and that’s a good idea. It makes no sense to tax money,” former US Rep. Ron Paul said during testimony in support an Arizona bill that repealed capital gains taxes on gold and silver in that state. “Paper is not money, it’s fraud,” he continued.

SB100 would also establish a state bullion depository. This would not only create a safe place to store precious metals; it also has the potential to facilitate the everyday use of gold and silver in financial transactions in Missouri.

The depository would be established in the Office of the State Treasurer. The depository would serve as “the custodian, guardian and administrator of gold, silver and other precious metals transferred or acquired by the state, or an agency, political subdivision or other instrumentality of the state.” The depository would also accept deposits of gold and silver by private individuals.

Significantly, SB100 would establish a mechanism for individuals to engage in transactions using precious metals including gold and silver.

Arkansas

A bill signed into law on April 11 has made gold and silver legal tender in the U.S. state of Arkansas, allowing citizens to use gold and silver coins to pay debts. The bill also clarifies that gold and silver “specie” (coins) will not be considered property for tax purposes, and transactions made with these precious metals will not result in tax duties.

Arkansas Embraces Gold and Silver as Legal Tender

The state of Arkansas has moved to make gold and silver function as legal tender in its territories. The “Arkansas Legal Tender Act,” signed by Arkansas Governor Sarah Huckabee Sanders on April 11, explicitly mentions that gold and silver “specie” (meaning any kind of bullion or coin containing these materials) can be used to pay for debts.

The act also specifies that “specie or legal tender shall not be characterized as personal property for taxation or regulatory purposes,” and that “the purchase, sale, or exchange of any type or form of specie shall not give rise to any tax liability.”

Over time, as residents of the state use both Federal Reserve notes and silver and gold coins, the fact that the coins hold their value more than Federal Reserve notes do will lead to a “reverse Gresham’s Law” effect, where good money (gold and silver coins) will drive out bad money (Federal Reserve notes). As this happens, a cascade of events can begin to occur, including the flow of real wealth toward the state’s treasury, an influx of banking business from outside of the state – as people in other states carry out their desire to bank with sound money – and an eventual outcry against the use of Federal Reserve notes for any transactions.”

no fiat currency has ever truly stood the test of time.

Ammendmum- Banks Creating Money? Fractional Reserve Banking

fractional reserve banks … create money out of thin air. Essentially they do it in the same way as counterfeiters. Counterfeiters, too, create money out of thin air by printing something masquerading as money or as a warehouse receipt for money. In this way, they fraudulently extract resources from the public, from the people who have genuinely earned their money. In the same way, fractional reserve banks counterfeit warehouse receipts for money, which then circulate as equivalent to money among the public. There is one exception to the equivalence: The law fails to treat the receipts as counterfeit

“Fractional-reserve banking thus creates a legal impossibility: through bank lending, the borrower and the depositor become owners of the same money.”

Arguing in favor of fractional-reserve banking would in fact be tantamount to saying that it is legal (or rightful or even lawful) that Mr. A does whatever he wishes with Mr. B’s property — without requiring Mr. B’s consent.

What, however, if the bank and the depositor both agree voluntarily that money deposits should be used for credit transactions via the issuance of fiduciary media? Even such a voluntary agreement would be in violation of the law of property rights.

Buying Gold and Silver Under $2000- https://sdbullion.com/

Buying Gold and Silver Over $2000- ITM Trading will walk you through moving your finances from an IRA or 401K, or other retirement savings

https://learn.itmtrading.com/chicks

The Constitution contains only two sections dealing with monetary issues. Section 8 permits Congress to coin money and to regulate its value. Section 10 denies states the right to coin or to print their own money. The framers clearly intended a national monetary system based on coin and for the power to regulate that system to rest only with the federal government. The delegates at the Constitutional Convention rejected a clause that would have given Congress the authority to issue paper money. They also rejected a measure that would have specifically denied that ability to the federal government (Hammond, 92). Although the Constitution does not state that the federal government has the power to print paper currency, the Supreme Court in McCulloch vs Maryland (1819) ruled unanimously that the Second Bank of the United States and the banknotes it issued on behalf of the federal government were Constitutional.

If the federal government only is permitted to issue money, coin or paper, then how could state banks issue money? State banks did not coin money, nor did they print any “official” national currency. However, state banks could print bills of credit in exchange for specie deposits. These notes would bear the issuing bank’s name and entitle the bearer to the note’s face value in gold or silver upon presentation to the bank. State bank notes were a form of representative money; they were not gold or silver, but they represented it. The notes were more convenient for conducting large transactions than their specie counterparts, and, more importantly for the extension of credit, could be produced easily whereas the gold and silver stock of the nation was relatively small and for the most part declining (Hixson, 12-13). The Supreme Court ruled in 1837 in Briscoe vs Bank of Kentucky that state banks and the notes they issued were also constitutional.

One potential problem with such a system is that banks may issue notes far in excess of their specie deposits. Customers appeared from time to time wanting to exchange their banknotes for specie. The banks, of course, made allowances for this by keeping some of the specie on hand at all times. If the specie/banknote ratio was too low, even a small unexpected increase in the withdrawal rate could force the bank into insolvency. Remaining depositors who had not withdrawn their specie would be left with worthless banknotes.

The public accounted for this risk of non-redemption by discounting the notes of banks that were considered risky. For example, a $20 banknote issued by a bank with a reputation of redemption problems might carry a 5 percent discount off its face value. In other words, a local merchant might only give a customer $19 worth of goods for a $20 note with the difference compensating the merchant for the risk of accepting the banknote. Discounts on notes among functioning banks ranged from about 95 percent for the riskiest banks to zero for banks with a high degree of public confidence. On the advent of the free banking era, there were 712 state banks in operation in the United States, each with its own currency (Kidwell, 59). Imagine the difficulty for a local merchant in tracking the riskiness and value of perhaps dozens of different banknotes in addition to the other concerns of his business.\

Summary

- The people’s representatives in Congress must develop and carefully control the money system and make sure the amount of money remains stable. That’s why the Constitution gives this power exclusively to Congress in Article I, Section 8.

- To be honest, a medium of exchange must have “intrinsic” value or in other words it must have value in and of itself. The Founders knew only money based on gold and silver would provide this value.

- There must be no fractional reserve banking. As Jefferson said: “No one has a natural right to the trade of a money lender but he who has the money to lend.”

- In order to prevent undue pressure on the demand for money and to make sure federal officials did not have so much power they could be ‘bought off’, the Founders clearly said that money from the federal treasury can be spent only for the 20 powers listed in Article I, Section 8, and then only if such expenditures were for the ‘general welfare’, or in other words, if such expenditures benefited the whole nation and not specific groups, locations, or businesses.

Helpful links

https://mises.org/

https://tenthamendmentcenter.com/

Books:

Case for Gold Pocket Edition

by Paul, Ron

The Creature from Jekyll Island: A Second Look at the Federal Reserve Paperback by G Edward Griffin

1931 $7 for his first car ( They Had Everything But Money pg 112)